If you’re a homeowner looking to tap into the value of your property, home equity investment can be a viable option. In this guide, we’ll explore the basics of home equity investment and offer tips on how to maximize its potential.

Table of Contents

Understanding Home Equity

Home equity is one of the most valuable assets a homeowner can possess. It refers to the difference between the current market value of a property and the outstanding mortgage balance on that property. Put simply, home equity is the portion of a home that is owned by the homeowner.

To calculate home equity, you first need to determine the current market value of your property. This can be done through a professional appraisal or by researching recent sales of comparable properties in your area. Once you have the estimated market value, you can subtract the outstanding mortgage balance from that number to determine your home equity.

For example, if your home is worth $500,000 and you still owe $300,000 on your mortgage, your home equity would be $200,000.

Having home equity can offer several benefits to homeowners. Firstly, it serves as a valuable asset that can be used to secure loans, obtain financing for major purchases, or fund home improvements. Additionally, as the value of a property increases over time, so too does the homeowner’s equity. This can provide a substantial source of wealth for the homeowner in the long run.

Types of Home Equity Investments

Home equity investments are financial products that allow homeowners to tap into the equity they have built up in their homes over time. There are several types of home equity investments available, each with its own advantages and disadvantages.

1- Home Equity Loans

Home equity loans are a type of loan that allows homeowners to borrow a fixed amount of money using their home equity as collateral. The interest rates on home equity loans are usually lower than those on unsecured loans, and the repayment terms are typically longer.

Home equity loans can be a good option for homeowners who need a large sum of money upfront, such as for home improvements, medical bills, or debt consolidation. However, they can also be risky because if the borrower defaults on the loan, they could lose their home.

2- Home Equity Lines of Credit (HELOC)

A home equity line of credit, or HELOC, is a revolving line of credit that allows homeowners to borrow money as needed using their home equity as collateral. HELOCs have a variable interest rate, which means that the interest rate can fluctuate over time based on market conditions.

HELOCs are a flexible option for homeowners who need access to funds over a longer period of time, such as for ongoing home improvements or for paying for college tuition. However, because the interest rate is variable, the monthly payment can also fluctuate, making it harder to budget.

3- Cash-Out Refinancing

Cash-out refinancing is a type of mortgage refinancing that allows homeowners to borrow money by taking out a new mortgage that is larger than their existing mortgage. The difference between the two mortgages is then paid out to the homeowner in cash.

Cash-out refinancing can be a good option for homeowners who want to access their home equity while also lowering their monthly mortgage payment. However, it can also be risky because if the homeowner defaults on the loan, they could lose their home.

4- Reverse Mortgages

A reverse mortgage is a type of loan that allows homeowners who are at least 62 years old to convert some of their home equity into cash. Unlike other types of home equity investments, the borrower does not have to make monthly payments on the loan. Instead, the loan is paid back when the borrower sells the home or passes away.

Reverse mortgages can be a good option for retirees who need a source of income but want to stay in their homes. However, they can also be expensive, with high fees and interest rates, and they can reduce the amount of equity that the borrower’s heirs will receive when the home is sold.

5- Shared Appreciation Agreements

A shared appreciation agreement is a type of home equity investment in which a homeowner sells a percentage of the future appreciation of their home to an investor in exchange for cash upfront. The investor then receives a share of the appreciation when the home is sold.

Shared appreciation agreements can be a good option for homeowners who want to access their home equity without taking on debt. However, they can also be expensive, with high fees and interest rates, and they can reduce the amount of equity that the homeowner will receive when the home is sold.

6- Sale-Leaseback Arrangements

A sale-leaseback arrangement is a type of home equity investment in which a homeowner sells their home to an investor and then leases it back from the investor. The homeowner receives cash upfront from the sale, and the investor receives rental income from the lease.

Sale-leaseback arrangements can be a good option for homeowners who want to access their home equity while also continuing to live in their home. However, they can also be expensive, with high fees and interest rates, and they can reduce the amount of equity that the homeowner will receive when the home is sold.

Factors That Affect Home Equity

Your home equity is influenced by several factors that can impact the value of your property. Some of these factors are within your control, while others are not. By understanding these factors, you can take steps to increase your home equity and maximize your return on investment.

1- Appreciation and depreciation of property values

Property values can appreciate or depreciate over time, depending on various economic and market conditions. Factors such as inflation, interest rates, and local real estate trends can all impact property values. When property values appreciate, your home equity increases. Conversely, when property values decline, your home equity decreases.

To increase your home equity through property value appreciation, you can make strategic home improvements, keep your property well-maintained, and stay informed about local market trends.

2- Home improvements and renovations

Home improvements and renovations can increase your home equity by adding value to your property. For instance, upgrading your kitchen, adding a new bathroom, or building a deck can all increase the value of your home. However, it’s important to consider the return on investment (ROI) of any home improvement project before undertaking it. Some improvements may have a high ROI, while others may not be as worthwhile.

3- Local market trends

Local market trends can have a significant impact on your home equity. Factors such as job growth, population growth, and new construction can all influence property values. Keeping up with local market trends and staying informed about the demand for homes in your area can help you make strategic decisions about your home equity investments.

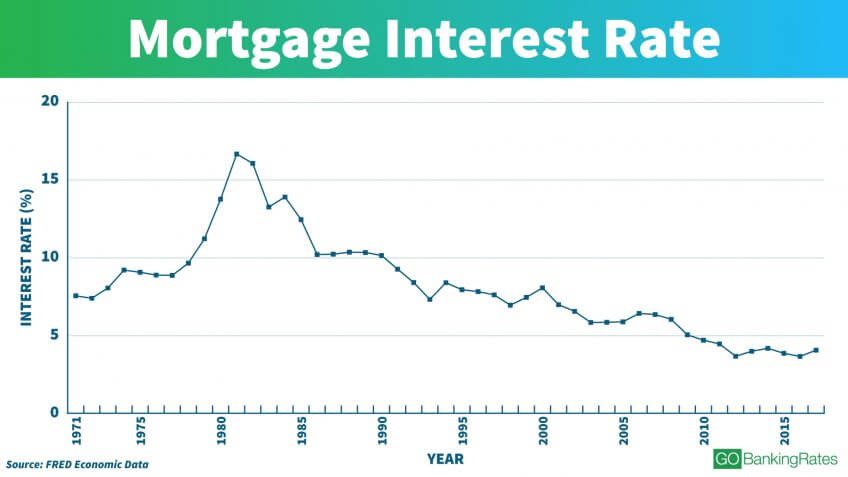

4- Mortgage payments and interest rates

Your mortgage payments and interest rates can also impact your home equity. The more you pay down your mortgage principal, the more home equity you will have. Additionally, lower interest rates can make it easier to pay off your mortgage and increase your home equity.

5- Economic factors and inflation

Economic factors such as inflation and interest rates can impact property values and therefore, your home equity. Inflation can drive up the cost of living, including the cost of home repairs and maintenance, which can impact the value of your property. Interest rates can also impact your mortgage payments, making it harder to build up equity.

6- Natural disasters and environmental factors

Natural disasters and environmental factors such as floods, fires, and storms can cause significant damage to your property and impact your home equity. It’s important to have adequate insurance coverage to protect your property and your investment.

Maximizing Your Home Equity Investment

Home equity investments can be a valuable tool for homeowners looking to tap into the value of their property. However, in order to make the most of your home equity investment, it’s important to carefully consider your financial goals and needs, choose the right type of investment, create a budget and payment plan, research lenders and interest rates, work with a financial advisor or real estate professional, and manage your investment effectively.

Knowing Your Financial Goals and Needs

Before considering a home equity investment, it’s important to take stock of your financial situation and determine your goals and needs. Are you looking to consolidate debt, fund home improvements, or pay for college tuition? Do you need a lump sum of cash or a line of credit for ongoing expenses? Understanding your financial goals and needs will help you choose the right type of home equity investment for your situation.

Choosing the Right Type of Home Equity Investment

There are several types of home equity investments, including home equity loans, HELOCs, cash-out refinancing, reverse mortgages, shared appreciation agreements, and sale-leaseback arrangements. Each type of investment has its own benefits and risks, so it’s important to carefully consider your options and choose the one that best fits your needs.

Creating a Budget and Payment Plan

Once you’ve chosen a home equity investment, it’s important to create a budget and payment plan to ensure that you can afford the payments and that you’re using the investment wisely. This may involve making lifestyle changes, cutting back on unnecessary expenses, and setting aside money for emergencies.

Researching Lenders and Interest Rates

Before committing to a home equity investment, it’s important to research lenders and interest rates to ensure that you’re getting the best deal possible. This may involve shopping around, comparing offers, and negotiating terms.

Once you’ve made a home equity investment, it’s important to manage it effectively to ensure that you’re maximizing its value. This may involve monitoring your payments, staying up-to-date on changes in interest rates, and working with your lender to address any issues that arise.

By following these tips and strategies, you can make the most of your home equity investment and tap into the value of your property in a smart and effective way. However, it’s important to remember that home equity investments come with risks and potential downsides, so it’s important to carefully consider your options and work with experts to make informed decisions.

Risks and Pitfalls to Avoid

When it comes to using home equity as an investment strategy, there are several risks and pitfalls that you should be aware of in order to avoid financial hardship and potential loss of your home. In this chapter, we will explore some of the common risks and pitfalls associated with home equity investments, and provide tips on how to avoid them.

1- Falling into debt and financial hardship

One of the biggest risks associated with home equity investments is the potential to fall into debt and financial hardship. When you borrow against your home equity, you are essentially taking out a loan that you must repay with interest. If you are not careful, you may end up borrowing more than you can afford to repay, and may struggle to make your monthly payments on time.

To avoid falling into debt and financial hardship, it is important to create a budget and payment plan before taking out a home equity loan or line of credit. This will help you determine how much you can afford to borrow, and will allow you to plan for your monthly payments. You should also make sure that you have a steady source of income to ensure that you can make your payments on time.

2- Borrowing more than you can afford to repay

Another common pitfall associated with home equity investments is borrowing more than you can afford to repay. When you take out a home equity loan or line of credit, it can be tempting to borrow as much as you are eligible for. However, this can be a risky strategy if you do not have a clear plan for how you will repay the loan.

To avoid borrowing more than you can afford to repay, it is important to be realistic about your financial situation and needs. Only borrow what you need, and make sure that you can afford to make your monthly payments without putting a strain on your budget. You should also consider the long-term costs of borrowing, including interest and fees, and factor these into your budget.

3- Failing to make payments on time

Making your monthly payments on time is critical when it comes to home equity investments. Failing to make your payments on time can result in late fees, increased interest rates, and may even lead to default or foreclosure.

To avoid missing payments, it is important to create a payment plan and budget that you can realistically stick to. You should also consider setting up automatic payments or reminders to ensure that you never miss a payment. If you are experiencing financial hardship or are having trouble making your payments, you should contact your lender immediately to discuss your options.

4- Being unaware of changing interest rates and terms

Interest rates and terms can change over time, and failing to keep up with these changes can be a major pitfall when it comes to home equity investments. Interest rates may rise, which can increase your monthly payments and make it more difficult to repay your loan. Terms may also change, which can affect the amount you owe and the length of time you have to repay the loan.

To avoid being caught off guard by changing interest rates and terms, it is important to stay informed and regularly review your loan agreement. You should also be prepared to refinance or renegotiate your loan if interest rates or terms change in a way that is unfavorable to you.

5- Falling victim to scams and fraudulent lenders

Unfortunately, there are many scams and fraudulent lenders in the home equity market, and falling victim to one of these scams can result in significant financial loss. Some common scams include lenders who offer “too good to be true” interest rates or who require large upfront fees or payments.

To avoid falling victim to scams and fraudulent lenders, it is important to do your research and only work with reputable lenders. You should also be wary of any lender who requires large upfront payments or fees, and should always read your loan agreement carefully.

In conclusion, understanding how to leverage your home equity investment can be a powerful tool for financial growth and stability. By researching and carefully considering your options, you can make informed decisions that will help you make the most of your property value.