Pursuing higher education is a valuable investment in your future, but the rising costs of college tuition can be daunting. Thankfully, numerous financial aid options are available to make your dreams of attending college a reality. In this blog post, we will explore ten powerful ways to secure financial aid for college. By following these strategies, you can navigate the financial landscape and access the funds you need to achieve your educational goals.

According to statistics:

83.8% of college students receive some form of financial aid, but public programs are underutilized.

What is Financial Aid?

Financial aid refers to monetary assistance provided to students to help cover the costs of education, including tuition, fees, books, supplies, and living expenses. It is designed to bridge the gap between what students can afford to pay and the actual cost of attending college or university. Financial aid programs are typically offered by governments, educational institutions, and private organizations to ensure that students from diverse backgrounds can access education without excessive financial burden.

Financial aid plays a crucial role in making higher education accessible and affordable for students around the world. Whether you’re a prospective college student or a parent planning for your child’s education, understanding the meaning and the importance of financial aid is essential.

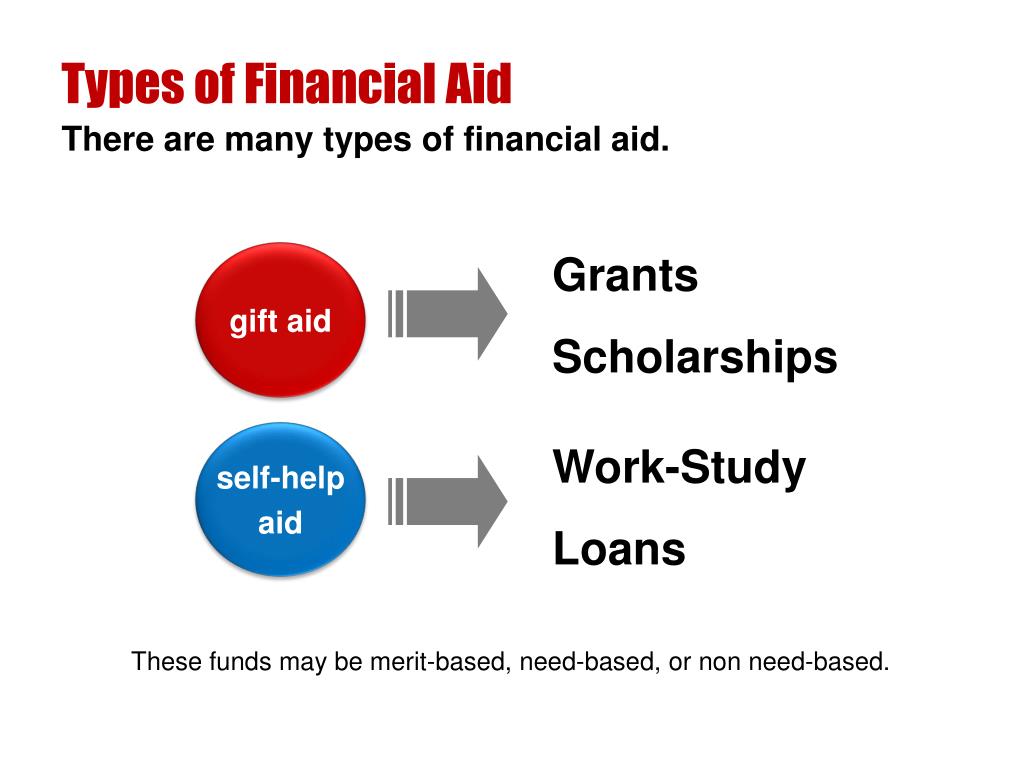

Types of Financial Aid

1. Scholarships

Scholarships are monetary awards given to students based on academic merit, talent, leadership skills, or specific criteria set by the awarding organization. Scholarships are highly desirable as they do not require repayment, making them essentially “free money” for education.

2. Grants

Grants are similar to scholarships in that they do not need to be repaid. They are typically awarded based on financial need, academic achievement, or specific circumstances. Grant programs can be funded by federal or state governments, educational institutions, or private foundations.

3. Work-Study Programs

Work-study programs provide students with part-time employment opportunities, usually on-campus, to help cover their educational expenses. Students work a set number of hours per week and earn a wage that can be used towards tuition, fees, or living expenses.

4. Loans

Unlike scholarships and grants, loans are borrowed funds that must be repaid with interest. Loans can be offered by the government (federal loans) or private financial institutions (private loans). Federal loans typically have lower interest rates and more favorable repayment terms compared to private loans.

10 Effective Ways To Secure Financial Aid For College

1. Fill out the FAFSA Early

The Free Application for Federal Student Aid (FAFSA) is the key to unlocking various financial aid opportunities. Submitting the FAFSA early increases your chances of receiving aid and allows you to explore federal grants, work-study programs, and low-interest loans.

2. Research Scholarships

Scholarships are a fantastic way to secure free money for college. Spend time researching and applying for scholarships that align with your academic achievements, extracurricular activities, and personal background. Websites such as Fastweb, Scholarships.com, and your school’s financial aid office are great resources to find scholarship opportunities.

3. Explore Grants

Grants are another form of financial aid that do not require repayment. They are typically awarded based on financial need, academic merit, or specific criteria. The Federal Pell Grant, for example, provides assistance to undergraduate students from low-income backgrounds.

4. Investigate Institutional Aid

Many colleges and universities offer their own institutional aid programs. These programs can include merit-based scholarships, need-based grants, and tuition assistance. Check with your prospective schools to understand the aid options they offer and any additional application requirements.

5. Consider Work-Study Programs

Work-study programs provide part-time employment opportunities for students, both on and off-campus. These programs not only help cover your expenses but also offer valuable work experience. Speak with your school’s financial aid office to learn about available work-study positions.

6. Seek Out Employer Assistance

Some companies offer tuition assistance or reimbursement programs as part of their employee benefits. Research if your or your parents’ employers provide such opportunities. If available, take advantage of these programs to lighten the financial burden of college.

7. Take Advantage of Tax Credits

Tax credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), can significantly reduce your tax liability. These credits provide financial relief for eligible educational expenses, including tuition, fees, and textbooks. Consult a tax professional or the IRS website to determine if you qualify for these credits.

8. Utilize Education Savings Accounts

If you or your family has been saving for education, consider using an education savings account, such as a 529 plan. These accounts offer tax advantages and allow you to grow your savings over time. Withdrawals from these accounts for qualified education expenses are typically tax-free.

9. Research State-Specific Aid Programs

Many states offer financial aid programs specifically tailored to their residents. These programs can include grants, scholarships, and loan forgiveness programs. Visit your state’s higher education website or contact the state’s department of education to explore available options.

10. Attend Financial Aid Workshops and Seek Professional Advice

Stay informed about financial aid opportunities by attending workshops organized by your school, local organizations, or educational institutions. These workshops provide valuable insights and guidance on securing financial aid. Additionally, consider consulting with a financial aid advisor or a professional financial planner who specializes in college planning. They can provide personalized advice and help you make informed decisions.

Benefits of Financial Aid

Financial aid provides numerous benefits to students pursuing higher education:

1. Increased Access:

Financial aid programs open doors to education for students who may not have the financial means to attend college otherwise. It promotes equal opportunities and fosters a diverse and inclusive learning environment.

2. Reduced Financial Burden:

By reducing the out-of-pocket expenses, financial aid relieves students and their families from the overwhelming costs associated with higher education. It allows students to focus on their studies and personal development rather than worrying about financial constraints.

3. Flexibility and Options:

Financial aid offers students the flexibility to choose their preferred educational institution based on their academic and personal goals, rather than being limited by financial constraints. It provides students with more options and opportunities to pursue their desired field of study.

4. Debt Management

While loans are part of financial aid, they can still be advantageous when managed responsibly. By using loans wisely and understanding the terms and repayment options, students can build credit and establish a solid financial foundation.

In conclusion,

Securing financial aid for college may seem like a challenging task, but with careful planning and research, you can access the resources you need.

Article by Copywriter Salary